The stock market continued plummeting in the third week of the New Year as investors got increasingly concerned and worried about the Federal Reserve’s action. The fed has decided to continue raising rates despite the slowing down of inflation. The regulator has said it will continue raising the rates until it wins the war against inflation. As a result, the S&P fell by 0.76%, while Dow Jones Industrial Average fell by 0.6% in the 3rd week of January,

So how do the interest rate and stock markets relate? The causal relationship between the two means a lot to the economy. Consequently, this post explores the relationship and suggests the steps the investor may take in 2023.

Table of Contents

Interest Rate Impact on Stock Market

The effect of the Fed interest rate on the stock market is not direct, but the trickle-down effects can impact the market. When the rates increase, loans become difficult to access and more expensive. If these changes prompt companies and people to freeze spending, company stocks could dwindle in value.

This seems to have been the case since the latest hike. Globally, stocks continue to fall. The S&P 500 fell by 0.7 while the Dow Jones Industrial Average fell by 0.76%. Nasdaq was not spared either. It lost 0.96% to close at 10,852.27 in the third week of January.

The same trend is being experienced In Europe. Share prices are declining, with tech stocks losing more than 2.9%, while Stoxx 600 lost 1.6% in the third week of the New Year. Share prices are expected to slip further due to the renewed EU calls for increased sanctions against Russia, Covid 19, and the imminent recession.

Recession Fears: Warning Signs Investors Watch

Economic Indicators Raising Concern

| Indicator | Signal |

|---|---|

| Yield curve inversion | High recession probability |

| Corporate layoffs | Slowing demand |

| Falling PMI data | Manufacturing contraction |

| Lower consumer spending | Demand slowdown |

Corporate Response to Economic Stress

FedEx Corporation (FDX)

| Action Taken | Reason |

|---|---|

| Office closures | Cost reduction |

| Hiring freezes | Demand uncertainty |

| CapEx cuts | Cash preservation |

Unique Insight:

Corporate cost-cutting often precedes official recession data by several quarters—an early signal markets price in quickly.

Was 2008 Worse Than 2002?

| Metric | 2008 Crisis | 2022 Inflation Shock |

|---|---|---|

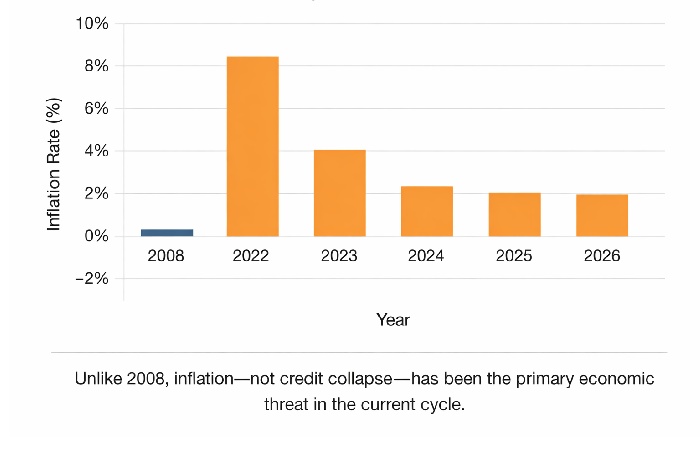

| CPI Inflation | -0.02% | +8.3% |

| Fed Policy | Rate cuts | Rate hikes |

| Bond market return | -4% | -12% |

| Stock market behavior | Sharp crash | Prolonged decline |

Insight to add:

Unlike 2008, inflation—not credit collapse—has been the primary economic threat in the current cycle.

What Market Data Suggests for 2026

Consensus Outlook

| Economic Factor | Expected Trend |

|---|---|

| Inflation | Stabilizing |

| Interest rates | Gradual decline |

| Equity returns | Earnings-driven |

| Volatility | Elevated |

Markets are transitioning from a liquidity-driven era to a fundamentals-driven one.

How Investors Are Adjusting Portfolios

Common Defensive Strategies

| Strategy | Purpose |

|---|---|

| Diversification | Risk reduction |

| Dividend stocks | Income stability |

| Lower leverage | Capital protection |

| Dollar-cost averaging | Volatility management |

New Year Outlook

Experts opine that 2023 will be a bumpy year for investors. Inflation will ease but will not go lower than 5%. Unemployment insurance has fallen to the lowest since September, and more job cuts are coming.

Conclusion

Although the stock markets are usually volatile, the 2022 figures suggest that we are already experiencing a mild recession. There is a lot of fear is in the air, and the markets are the risk of crashing.

So as an investor, diversification is the only way out. However, the actions you will take will depend on your special circumstances.