Table of Contents

Introduction:

Crypto trading has become one of fintech’s most profitable businesses. It can be very speculative and knowing what trading instruments are available could help investors make better, less risky decisions.

The article provides an overview of the different order kinds in crypto, similar to those used in stock trading. However, due to the particular structure and conditions of the crypto market, they can be used differently.

In the early days of cryptocurrency, exchanges were commonly dubbed the “wild west” due to the proliferation of unregulated and risky trades, culminating in the infamous 2014 MtGox hack.

After Satoshi Nakamoto launched Bitcoin (BTC) in 2009, there were limited opportunities to exchange cryptocurrency for fiat currency or commodities. Most of the time, trading would be peer-to-peer (P2P) via the popular bitcoin forum Bitcoin talk.

These were risky trades, but Bitcoin was worth nothing back then, so trusting a stranger didn’t matter because the money involved was minimal compared to today.

Twelve years later, heavily regulated and more trusted exchanges have taken over the crypto scene worldwide by complying with strict Know Your Customer (KYC), Anti-Money Laundering (AML) and Counter-Terrorism (CTF) financial laws.

After all, the cryptocurrency exchange market is worth billions of dollars, with exchanges collectively trading over $50 billion daily.

Today, cryptocurrency exchanges compete to provide traders with a range of tools to help them make the best trading decisions to maximize profits and curb losses.

What Is An Exchange Order Book?

An order book is a separate list of buy (bids) and sells (asks) open orders for a specific trading pair. It can be identified as a marketplace that anyone can join by placing an offer if they want to buy an asset or asking for a price if they’re going to sell it.

The open order stays in the order book until it’s cancelled or someone accepts the bid or agrees to pay the asking price for the specific asset in the case of a sale.

Each trading pair, like BTC/USD or BTC/Ether (ETH), will have its order book.

What Are The Common Crypto Order Types?

Different order types allow traders to buy or sell a cryptocurrency with a lot of flexibility, whether they want to target a specific selling or purchasing price or define the timing of the transaction.

Orders can live in a spot market where cryptocurrencies are traded for immediate execution or in a futures market where contracts can establish that an order is fulfilled at a future date.

Stop orders would enable traders to choose the price the order should execute and are usually set to minimize losses if the cost of an asset drops considerably.

Market orders

A market order is an instruction by a trader to buy or sell a cryptocurrency at the best available price in the crypto market and provide instant execution. It is considered the simplest and most basic type of crypto order.

Pros

Crypto market orders are perfect for traders who do not wish to wait for a target price and, unlike all other orders, which are primarily based on the prospect that a fee will hit the target, market orders are guaranteed to be fulfilled.

A crypto market order automatically matches the best available limit order in the order book, removing liquidity. Since market orders are executed instantly, they cannot be cancelled, unlike limit and stop orders. Therefore, it’s considered a taker order, and it’s the reason why exchanges usually charge market orders a higher fee.

Cons

Slippage is a significant drawback of market orders. It occurs when large market orders usually match multiple charges in the order book and may be susceptible to unfavorable changes in price. Simply put, slippage happens when an order fills at a lower price than expected.

It usually happens because there isn’t enough liquidity to fill a large order at the desired price so that the next available lower price will fill in. If the order value is not very big, a price difference might not even be noticeable. However, if the trade size is considerable, slippage may represent a big issue.

Exchange liquidity can be a real issue in cryptocurrency markets, prompting many experts to believe that some volumes declared might be faked or inflated.

Generally, traders who want to control their trading strategy better might consider using limit orders.

Limit orders

A crypto limit order is an instruction to buy or sell a cryptocurrency only at a price specified by the trader. It is best suited for the trader who can patiently wait for a price target to be reached.

Pros

Unlike market orders, crypto limit orders give more asset price and amount flexibility. They let traders set a minimum price and will only perform at that price or higher.

Investors can either take another trader’s open order on the exchange or place an available order that someone else might take.

The flexibility of limit orders allows traders to have better control and minimize their risk while allowing them to stay away from constantly watching the market.

Cons

Limit orders are only fulfilled if the designated price is reached and, even in that case, execution is not guaranteed, or there’s a chance they can even end up being filled only partially. Orders are first ranked by price and then on a first-come-first-serve basis. Therefore, once the price is hit, the order might still not be executed because other previously placed orders of the same amount are waiting to be filled.

A good practice would be to set the limit price a little above the selling price or below the buying price of psychological levels. As others might use this tactic too, it’s helpful to look at the order books to spot the expenses that do not reflect many orders to have a better chance to execute it.

Limit orders are considered “makers” because an open order is immediately placed into the order book and injects liquidity into the market.

Limit order vs stop order

A stop order is significantly different from a limit order because it includes a stop price meant only to trigger an actual order when the set price has been reached. Moreover, the market can see a limit order, while a stop order can’t be seen until triggered.

What Is Crypto Trading?

Crypto trading involves speculating on the price movement of cryptocurrencies through a CFD trading account or buying and selling underlying coins through an exchange.

Crypto CFD Trading

CFD trading is derivatives that allow you to speculate on the price movements of cryptocurrencies without acquiring ownership of the underlying currencies. You can go long if you think the cryptocurrency will rise in price or go short if you think it will fall.

Both are leveraged products, meaning you only need to make a small deposit, known as a margin, to get a full view of the underlying market. Your profit or loss is still calculated based on your total position size, so leverage increases profit and loss.

Buying and selling cryptocurrencies through the talk

Crypto Trading whole And exchange, you are buying coins yourself. You must create an account on the exchange, deposit the full value of the advantage to open a spot and store the cryptocurrency tokens in your wallet until you are ready to sell.

Exchanges have their steep education curve as you need to become familiar with the technology and learn how to use data in a meaningful way. Many exchanges also limit how much you can deposit, and maintaining an account can be very expensive.

How do cryptocurrency markets work?

Cryptocurrency markets are decentralized, meaning they are not issued or maintained by a central authority such as a government. In its place, they work on a network of processers. Crypto Trading However, cryptocurrencies can be bought and traded through exchanges and stored in “wallets”.

Different traditional currencies, cryptocurrencies only exist as a shared digital greatest of ownership stored on a blockchain. When a user wants to send cryptocurrency elements to extra user, he sends them to that user’s digital wallet. A transaction is not careful final until it has been verified and added to the blockchain through mining. New cryptocurrency tokens are also commonly created.

What is blockchain?

Blockchain is a shared digital record of recorded data. For cryptocurrencies, this is the transaction history of each unit of the cryptocurrency, showing how ownership has changed over time. Blockchain works by recording contacts in “blocks”, with new blocks added to the beginning of the chain.

What is cryptocurrency mining?

Cryptocurrency mining is the process by which the latest cryptocurrency transactions are verified, and new blocks are added to the blockchain.

Business Confirmation

Crypto Trading Mining computers select pending transactions from the pool and check if the sender has enough funds to complete the transaction. The second check confirms that the sender authorized funds transfer using their private key. It includes checking the transaction details against the transaction history stored on the blockchain.

Creating a new block

Mining computers compile in force transactions into a new block and try to generate a cryptographic link to the previous block by discovery a solution to a complex system. When the computer manages to generate the link, it adds the block to its version of the blockchain file and sends the update over the network.

What Drives The Cryptocurrency Markets?

Cryptocurrency markets move based on supply and demand. However, because they are decentralized, they tend to remain free from many of the economic and political problems that plague traditional currencies. While there is still a lot of doubt surrounding cryptocurrencies, the following factors can have an important effect on their prices:

- Stock: the total number of coins and the rate at which they are issued, devastated, or lost.

- Market capitalization: the value of all present coins and how users perceive their development.

- Press: how the cryptocurrency is presented in the media and how widely it is cover

- Integration: the extent to which a cryptocurrency is easily integrated into current infrastructure such as e-commerce payment systems.

- Key Events: Major events such as regulatory updates, security breaches, and economic downturns.

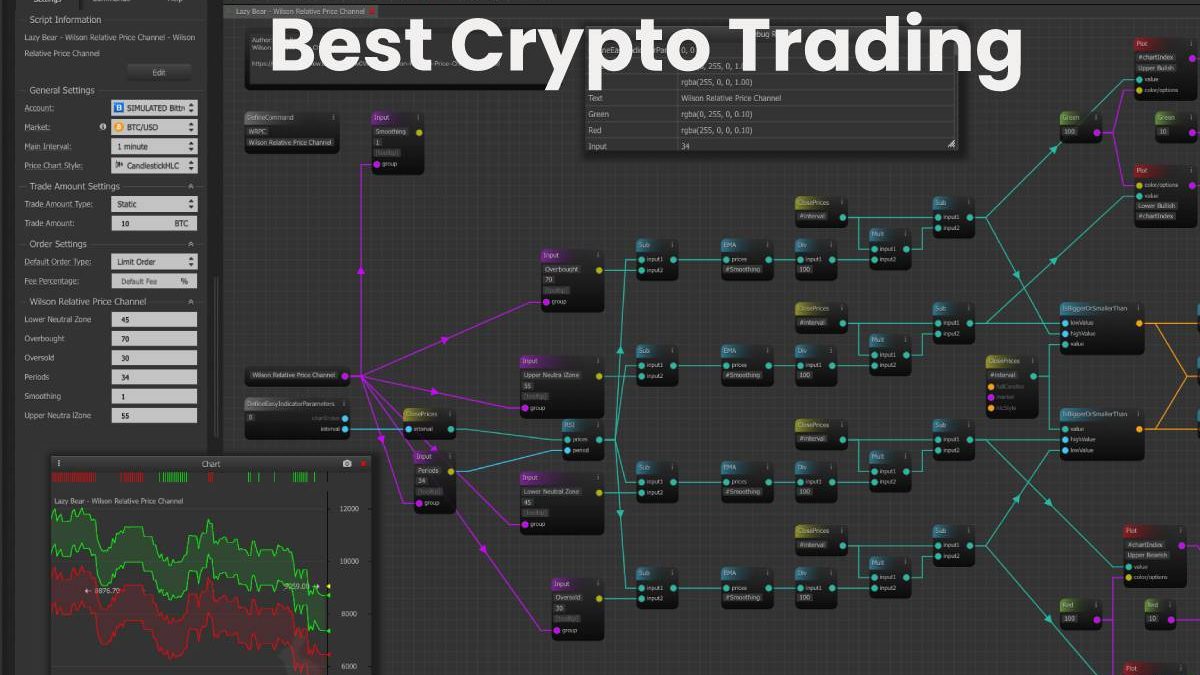

Cryptographic control software integrations

When trading with crypto robots and automated tools, getting a large number of trades can be easy. It can make it difficult to report your crypto gains and losses to your taxes if you don’t have the right software. Looking at crypto tax software companies compatible with your trading platform of choice is important. CoinLedger is the leading crypto control software that works with many of the top crypto trading bots, terminals, and tools on this list. Good crypto tax software to support your crypto trading strategy will simplify and hassle-free your tax filing.