E-wallets Write For Us

E-wallets You do your shopping, and when you have nothing left, you start fishing in your purse for your wallet. A line begins to form behind you as you sift through old gift cards and receipts to find your debit card. For Submitting Your Articles, you can email us at contact@supercomputerworld.com

Or you are shopping online for a new pair of shoes. You can find what you want, but when you want to pay, you must find your credit card, manually enter all the information, and force your brain to remember which billing address is correct.

The solution? Electronic wallets. As long as you have a smartphone or internet connection, you can completely erase your physical wallet.

How did E-wallets technology come about?

E-wallets may seem like a recent development, but the technology to transfer money virtually has been around for a while. In Tucker’s eyes, the origins date back to 1998 with the creation of PayPal.

“PayPal was probably the first example of an alternative e-wallet payment method here in the United States,” he said. “Then they bought Venmo, and the banks responded by creating a cell.”

An e-wallet is an application that lets you store or spend money digitally. Under this umbrella, there are various apps with different functions, all of which are still considered e-wallets. For example, Apple Pay can be accepted as a payment method at many physical stores, while Venmo and Cash App can be used to send money to friends and family quickly. But to some extent, it is considered a kind of e-wallet as it allows you to store and transfer funds. While the technology isn’t new to the United States, Tucker said much of the country is still card-centric and therefore lags behind the rest of the world in e-wallet adoption.

5 Popular E-wallets

- Cash App: A digital wallet that allows users to store cards, send money to friends, and buy cryptocurrencies. The Cash app can be used for online and in-store purchases.

- Venmo: A mobile app that can be linked to a user’s bank account and transfer money to other Venmo users to pay for services or goods.

- Paypal: An electronic wallet, available in mobile and web versions, allows users to pay for purchases online and send money to family or friends.

- Apple Pay – An electronic wallet, only available on Apple mobile devices, where users can store cards, coupons, airline tickets and more. Apple Pay can be used like a physical card in many physical stores.

- Google Pay – Like Apple Pay, Google Pay can be used to store card information and pay for purchases. Google Pay is available to users with a Google account.

“The world has Paytm, Alipay and WeChat Pay, but the United States has fallen behind in the market,” Tucker said. “It took a long time for most consumers to become confident in the security of an electronic wallet.”

But things are changing fast. According to a CivicScience study, approximately 60% of American adults now use the electronic wallet or digital payment technology. And also, Tucker compared the rise in e-wallet adoption to the increase in QR code adoption; both technologies are gaining popularity partly due to the pandemic.

“The E-wallets and contactless technology changed because of Covid: nobody wanted to touch things,” he said. “The pandemic has changed how consumers look at things and has made them try things they’ve never tried before.”

How do E-wallets work?

An eWallet is a digital way of transferring money or transacting goods and services. It looks and feels different from a traditional wallet, but eWallet technology isn’t that different from what we’re used to. And also, Just like the ones you carry in your bag, an eWallet is a place to store cards, tickets, and coupons for future use.

Jeanniey Walden, director of innovation and marketing at New York-based payments technology company DailyPay, compared e-wallets to Tupperware containers, where food is stored before it’s reheated or transferred to the appropriate china.

E-wallets can be used to pay for products and services online, but their use is not limited to the Internet. While it’s not widespread, many vendors like McDonald’s, Best Buy, and Texaco have kiosks that can accept Apple Pay payments at brick-and-mortar locations. E-wallets aren’t exactly like a bank account, but businesses must comply with many of the same regulations and restrictions as banks.

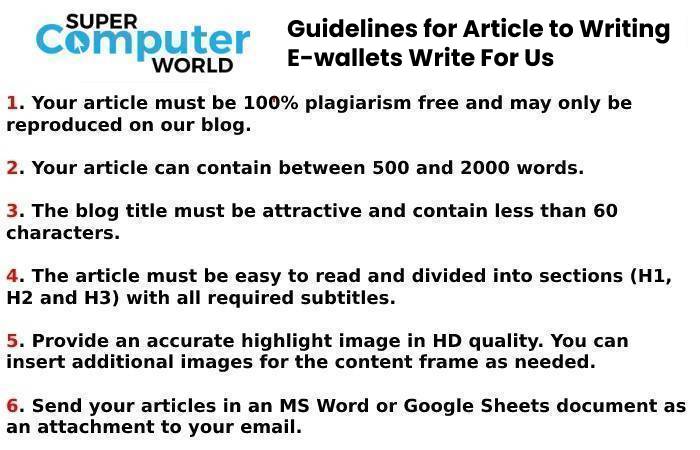

How to Submit Your Articles

For Submitting Your Articles, you can email us at contact@supercomputerworld.com

Why to Write For Super Computer World – E-wallets Write For Us

Search Related Terms to E-wallets Write For Us

Electronic Data Store

Electronic Device

Software Program

Electronic Transactions

Digital Currency

Goods And Services

Near Field Communication

Driver’s License

Cryptocurrencies

Bitcoin.

Google Pay

Apple Pay

Kenya

Tanzania

Mastercard

Flipkart

Microfinancing

Health Card

Online Service

Search Terms for E-wallets Write For Us

E-wallets Write For Us

looking for guest posts

guest posting guidelines

become a guest blogger

guest post

becomes an author

suggest a post

contributor guidelines

guest posts wanted

submit an article

writers wanted

guest posts wanted

submit the post

contributing writer