Table of Contents

Introduction:

Trading Station has enabled traders to gain a financial advantage. Whether you’re new to trading or a seasoned pro, Trading Station offers a platform that can help you up your game. We offer award-winning software for all trading products, including stocks, options, and ETFs.

Trading Station robust trading platform, high-quality market data, and fast trade executions make it a strong choice for active agents. Its trading systems remain available during spikes in trading volume. Trading Station has long been considered the gold standard among serious traders, the company has made its offerings more attractive to casual investors and novice and intermediate-level traders who want to improve their skills. Despite these efforts, the high account fees, educational content gaps, and absent life planning tools are still areas where our newly developed, retail-focused ratings model needs improvement.

Pros & Cons

Pros

- Pro-level trading platform with fast, reliable order execution

- Competitive Pricing

- Intuitive trading interfaces and advanced order types

- Dynamic symbol sorting and scanning tools

- The powerful simulated trading environment

- Robust strategy development and automation

Cons

- Steep learning curve

- A sophisticated interface can be intimidating

- Zero no-transaction-fee mutual funds

- Potentially long hold times for tech support

Pros Explained

- Trading Station has a pro-level trading platform with fast, reliable order execution, exceptional charting, technical analysis, order entry, strategy development, and trade automation technology.

- A combination of advanced order routing technology, regular and rigorous reviews of speed, execution quality, and price improvement delivers quality trade execution.

- Trading Station has commission-free stock, ETF trades, and competitive pricing on options, futures, futures, and crypto. Previously Trading Station had a TS SELECT and TS GO offering, with TS SELECT accounts requiring a $2000 minimum versus $0 with TS GO, but the TS SELECT minimum is gone, and TS GO has been retired.

- Trading Station features intuitive trading interfaces and advanced order types. There is one-click and drag-and-drop trading with multiple, easy-to-use interfaces, including Chart Trading, Matrix, Quick Trade, Trade Bar, and keyboard trading. Place conditional orders, trailing stops, and profit targets across all platforms.

- Trading Station offers dynamic symbol sorting and scanning tools. Radar Screen sorts a list of up to 1,000 pre-defined symbols in real time based on user-defined criteria. The scanner app scans thousands of symbols (e.g., all stocks) based on 180+ technical and fundamental indicators and custom studies.

- Trading Station has a powerful simulated trading environment. You can test trading ideas and strategies, hone your trading skills, and execute demo trades with real-time streaming market data—without risking capital.

- Trading Station enables robust strategy development and automation. You can build, test, optimize, monitor, and fully automated trading strategies using pre-built strategy components or EasyLanguage, Trading Station proprietary programming language.

Cons Explained

- Trading Station has a relatively steep learning curve. Learning how to use all the platform’s features and maximize its potential takes time and effort.

- The Trading Station platform is sophisticated, making it seem overwhelming initially, particularly for less-experienced traders. That said, it’s easier to navigate and learn than you might think.

- Unlike many brokers, Trading Station does not offer any no-transaction-fee mutual funds. However, this doesn’t tend to be an issue because the broker is geared toward active traders, not buy-and-hold investors.

- Trading Station has some potentially long hold times for tech support. Hold times can be lengthy when calling tech support and frustrating if you have a problem during trading hours.

Usability

TradeStation’s account opening process is streamlined and quite quick. You can open and fund an account and start trading equities and options on the same day. The Trading Station website has undergone several updates over the last several years, and it’s easy to find details about pricing, products, platforms, and educational offerings.

Trading Station customers can trade on multiple devices and platforms. This includes the flagship Trading Station 10 Desktop platform, a web-based platform with most of the functionality of the desktop version, and a full-featured mobile app for iOS and Android.2 No matter your platform, you can view charts with real-time streaming data and news, add technical indicators, and create custom watchlists. The same instruments are available across all platforms, and there are multiple ways to enter trade orders—with the option to use conditional orders, profit targets, and stop-loss orders.

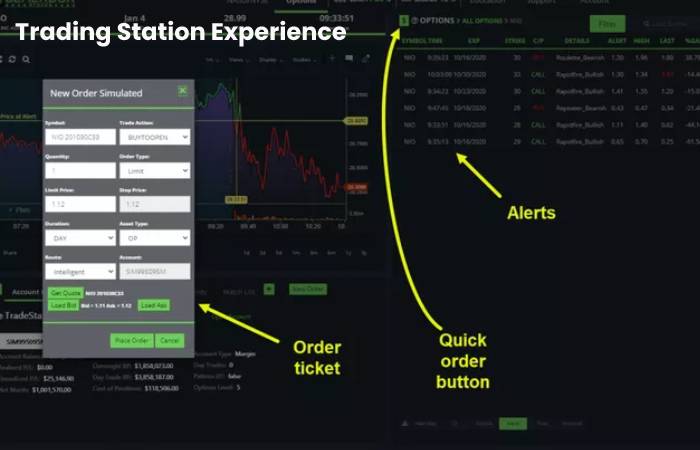

Trading Station Experience

While Trading Station can initially seem daunting, the platform’s workflow is intuitive and fully customizable. It’s easy to go from research to trade, and you can set up trade defaults, hotkeys, and workspaces to customize your experience (workspaces let you organize and save the various analysis and trading apps you want to use).

TradeStation calls its trading tools apps. These apps are integrated with the platform, so you can just click to launch. There are more than a dozen built-in trading apps, including “Chart Analysis”, “Hot List”, “RadarScreen”, “Matrix”, “Time & Sales”, “TradeManager”, “OptionStation Pro”, and many others. There is also the TradeStation TradingApp Store, where you can choose from hundreds of third-party tools for free or for a monthly fee.

A handy platform feature is TradeStation’s window linking. It allows you to connect one window with another (or multiple windows) based on a common symbol or interval. For example, you link a RadarScreen window, a Chart Analysis window, and the Matrix. You can click on any symbol in RadarScreen, and the Chart Analysis and Matrix windows will automatically update to that symbol. Window linking makes fast work of research and order entry.

All Trading Station platforms offer real-time streaming data, and you can place, modify, and cancel orders directly from a chart or by using keyboard shortcuts. Alternatively, using the Matrix, you can monitor the market and place trades at the price level you want (including one-click limit orders). Dubbed the “Swiss Army knife of trading tools,” the Matrix combines a detailed market depth window, an advanced order-entry tool, and a precise order-tracking system into a single, customizable window.

Trading Station 10 Desktop allows you to stage orders for later entry, and all platforms (including mobile) let you enter multiple orders simultaneously. You can open the Option Station Pro App directly from the main platform if you want to trade options. To buy and sell cryptocurrencies, launch the Crypto web platform when you log into the Trading Station website—and remember that you’ll need a separate crypto account to trade.

Where Trading Station shines

Professional trading experience: Trading Station is a top-notch choice for serious investors seeking professional-level trading experience. In fact, at one time, Trading Station catered solely to professional brokers and money managers. Now, regular investors have access to the firm’s high-octane tools, especially after the company cut trading costs to $0 and lowered the minimum investment to $0 for its TS GO offering.

Advanced options: More attractive to experienced investors will be the broker’s TS Select plan, which requires a $2,000 initial investment but gives access to the broker’s full suite of tools and free trades from the powerful Trading Station 10 Desktop platform.

Where Trading Station falls short

Mutual funds: Trading Station offers more than 2,000 funds but lacks no-transaction-fee funds.

Add-on fees: Access to many of Trading Station features require an additional financial outlay or subscription for those who do not meet certain account or trading minimums. Trading Station also charges an annual inactivity fee of $50 for accounts that don’t maintain certain balance or trade minimums.

Trading Station is best for:

- Advanced and active traders.

- Stock, options and futures traders.

- Cryptocurrency trading.

Ed’s Trading Station

I was asked a few inquiries about my station setup as it differs from most retailers. I think I wrote an article about my setup at the time a few months ago, but I did a major upgrade. Laptops power everything. As you may have read, I tried different configurations to find my comfort zone. I started with 2 laptops, then 1 laptop and 3 small monitors, then 1 laptop and 2 larger monitors, then 2 laptops and 2 large monitors, then what I have now; 1 laptop with 4 large screens for charts and platform and 1 laptop and 2 screens for chat and social media. I found it easier to see all the tickers in my watch list on individual monitors instead of constantly switching between screens to watch them. I’m happy with what I finally achieved.

To answer the main question I get; why a laptop? I want portability. I like to change the landscape. Sometimes I like looking out the front window, sometimes out the back, and sometimes sitting on my porch. I even like to put my desk on the terrace on sunny days. I wanted to be able to trade anyplace. So I started looking for a light, sturdy desk with wheels.

Many people have said I shouldn’t use a laptop for a trading station and need more power. I’m not a computer expert or an IT professional, but I’m an engineer. I believe I can understand information and data and make an informed decision on almost anything technical. I also like to keep it simple and see it as a kid, so that’s what I did in this case. The reality I’ve come to is that trading platforms and charting software don’t need the performance required by these PC gaming systems, but many people seem to confuse the two and say that you need this performance. Gaming computers need success. In a way, I wanted to prove them wrong, but in the end, I just wanted something I liked and felt comfortable with.

Tips To Build a Modern Trade Station

I’m a trading educator for Warrior Trading, and today I’m going to bring you on my new trading desk journey. So I’m going to talk about every one of the tools that I use every day to trade the market, and I hope you guys can also find some tips and tricks that you can use to improve your general settings when it comes to your trading desk. Because in the end, ultimately, the goal is to provide for yourself the best possible environment to take your decisions, especially when it comes to day trading. Being in a positive environment, in an environment where you have the information that you need basically available to you in no time, will make the difference in how you actually could manage your trades. So it is going to have an impact in your trading results as well ultimately.

For me, what I wanted to achieve when I designed my new desk was effectiveness. I wanted every tool I needed to support my decision-making process and to be as minimal as possible. So when thinking about how to set up your own trading desk, it is always good to actually spend time understanding what are your needs when it comes to trading, and so that you can design an overall desk that is responding to your actual needs.

So I would start with the actual computer here that I use. My workstation is here. The laptop is an HP workstation. So it’s a laptop, but a workstation from HP. It’s a ZBook series. I’m not going to talk about every detail of the workstation, because I’m actually going to include all the details of the models I have in the description below. So you can go and check those for yourself.

Overview

is a premium online forex trading station designed to provide clients with market insight and a high level of execution. It allows you to trade currencies and CFD symbols. The main features are one-click order execution and trading from charts. The built-in Marketscope charting application also allows using custom indicators and strategies written in the Lua language. We are proud that this product has been recognized and awarded by major financial industry associations

Innovative Platform

Trading Station is the innovative, award-winning trading software built just for you. We’ve used ten years of trader feedback and data to create a robust platform that meets the needs of new and experienced traders alike.

Automated Strategies

Trading Station opens a world of possibilities with automated strategies, custom indicators and the ability to backtest strategies. Some of the best traders use automated strategies to remove the human element from trading. With Trading Station, automated strategies are added with just a few clicks.

Strategic Control

Identify key areas where your trading strategies can be improved and gain confidence in your strategies before entering the real forex market.

– Visual display of trades

– Balance sheet and equity statement

– Trading history with all trading details

– Detailed performance overview

Strategy Optimization

Trading Station’s strategy optimizer can test a wide range of strategy inputs, allowing you to quickly find combinations of inputs that you find favorable. The strategy optimizer offers several sortable data fields to find optimal input combinations.

Skins

Trading Station allows you to customize the look by choosing from a variety of pre-formatted skins. The following five basic skins are available: Standard, ХР, Midnight, Mac, Metallic, Vista.

Related searches

trading station ii